Build a Scalable Finance System (Without Hiring a Full Team)

Why fractional accounting is the most efficient model for brands under $50M.

by Foodbevy

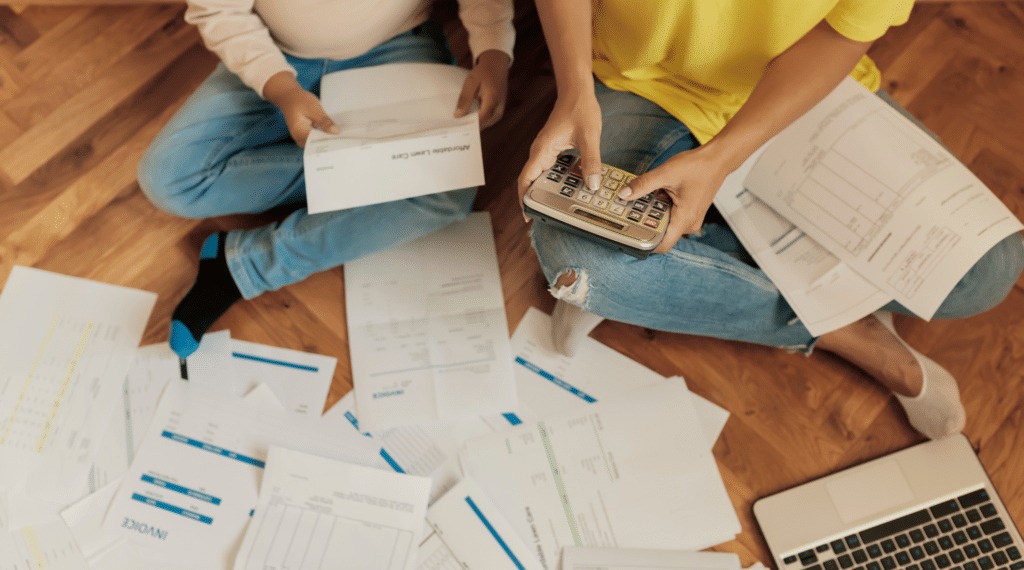

Let’s imagine a small, yet emerging CPG business, celebrated for its artisanal, organic snacks. Stephanie, the entrepreneur behind this venture, launched her business with a passion for offering healthier, sustainable snack options. However, Stephanie’s journey in growing her brand uncovers a critical challenge that is all too familiar in the small CPG world: the struggle with high-interest debt. It began with an initial loan to get her production off the ground. As the business expanded, the need for manufacturing equipment, larger inventories, and extensive marketing efforts led her to take on additional loans and lines of credit, each carrying higher interest rates.

For small CPG businesses like Stephanie’s, comprehending the landscape of business financing is crucial. The world of small business debt is diverse, encompassing traditional loans, lines of credit, business credit cards, and even convertible debt. Each option carries its own set of advantages, risks, and costs, particularly when it comes to interest rates.

The ease of acquiring high-interest loans and credit lines can lead small CPG businesses into a dangerous pattern known as debt stacking. This occurs when a business takes on new debt to pay off existing loans or to meet ongoing financial obligations, often at increasingly higher interest rates. For entrepreneurs like Stephanie, this can create a crippling cycle that’s hard to break.

For small CPG business owners like Stephanie, navigating the landscape of business debt requires not only an understanding of different financing options but also strategies to manage and avoid falling into the high-interest debt trap. Here are some practical approaches:

In the challenging financial landscape that small CPG businesses navigate, the role of a supportive financial partner becomes invaluable. Aion Financial offers lines of credit for emerging CPG brands and understands the business, challenges, and opportunities of working in a DTC and Retail environment.

Foodbevy Offer:

Sign up for a bank account for free and access credit lines from $5,000 to $500,000. As a special offer for the Foodbevy community, Aion is completely waiving 3-months fee of $99/month to access credit lines.

Why fractional accounting is the most efficient model for brands under $50M.

News from Mash Gang, RoRo’s Baking Company, Oval Coffee Roasters, Fly By Jing, Koia, Doughp, Doich, TRUBAR, Magnolia Bakery, Papa Mountain and SkinnyDipped.

In this episode, I talk with John Ferrante from EO Space about how high-growth CPG brands find white space, build emotional differentiation, and use packaging as a true growth lever.

Be the first to get our latest news stories, interviews, and discounts.

The online the community for food and beverage founders