- Finance

How To Use Purchase Order Financing to Fund Growth

By:

Growth Is Exciting—But Expensive

Imagine this: You’ve been hustling for months to land a deal with a major national retailer. Finally, it happens—they send over a purchase order that could double your brand’s footprint overnight. You’re thrilled… until you realize your current cash reserves won’t cover the production run needed to fulfill it.

This is the cash flow conundrum that almost every growing CPG brand faces. Scaling isn’t just about making more products—it’s about navigating a complex web of supplier deposits, freight costs, and extended payment terms from retailers. Even if you’re profitable, the timing mismatch between expenses and revenue can create massive pressure on your working capital.

Enter purchase order financing—not just as a financial safety net, but as a strategic tool to unlock growth you might otherwise have to delay or walk away from.

The Hidden Costs of Scaling Fast

Growth sounds like a good problem to have—and it is—but it’s also incredibly capital-intensive. For CPG brands, scaling involves upfront costs that add up quickly:

- Production deposits to secure manufacturing time

- Raw materials and packaging at higher MOQs

- Freight and logistics costs, especially for large retail rollouts

- Slotting fees or marketing contributions for big-box accounts

These expenses hit before you see a dime from retailers, many of whom operate on net-30, net-60, or even net-90 payment terms. That means you’re funding growth months before you get paid, which can lead to painful tradeoffs—like holding off on new product launches or turning down orders you can’t afford to fulfill.

Traditional loans can be slow and hard to qualify for. Equity funding takes time and often dilutes ownership. PO financing, on the other hand, is built to support cash flow around confirmed orders—making it a practical middle ground for many brands.

Apply for PO Financing Early

Most founders don’t think about applying for PO financing until the pressure is on—and by then, the clock (and the cost) is working against them. Applying early turns PO financing from an emergency move into a powerful advantage.

When you secure financing ahead of time, you:

- Expand Your Options: More lenders are willing to work with you, offering better terms and lower rates.

Avoid Premium Pricing: Emergency financing usually comes with hefty fees—early planning helps you keep more margin. - Speed Up Production: With financing already lined up, you can move faster to confirm orders and lock in production timelines.

- Strengthen Retail Relationships: Retailers want reliable partners. Showing up ready to fulfill large POs builds long-term trust.

If you know a big retail launch, seasonal push, or DTC drop is coming, start the financing conversation early. Future-you (and your bottom line) will thank you.

When PO Financing Becomes a Strategic Tool (Not Just a Lifeline)

Most founders first hear about PO financing when they’re scrambling to fulfill a large order without the cash to cover it. But savvy operators are starting to use it more proactively—as a strategic lever to drive smart, accelerated growth.

Some real-world use cases include:

- Retail Expansion: Entering a national chain like Whole Foods or Target where large POs strain cash reserves.

- Seasonal Scaling: Meeting Q4 demand or prepping for a big seasonal launch.

- Collaborations and Limited Drops: Funding high-volume, short-window DTC pushes without overextending.

- Launching New SKUs: Introducing new products that require a separate production run and packaging investment.

PO financing allows founders to say “yes” to big opportunities without risking everything. It adds a layer of flexibility to your business model—one that’s tied to actual revenue, not just projections.

Smart Founders Use PO Financing to…

The best use of PO financing isn’t to plug holes—it’s to create breathing room and unlock potential. Here’s how growth-minded CPG founders are using it strategically:

- Protect Cash Reserves: Keep your bank balance intact for operational needs or emergency buffers.

- Avoid Dilution: Delay a funding round until you’ve increased revenue or valuation.

- Fulfill Major Orders: Say yes to scaling opportunities without maxing out personal credit or credit lines.

- Strengthen Supplier Relationships: Faster payment builds trust with co-mans and suppliers—potentially leading to better terms in the future.

Think of PO financing not just as funding, but as growth capital tied to real, de-risked revenue.

How to Integrate PO Financing Into Your Capital Strategy

To use PO financing well, it should be part of your overall capital plan, not a last-minute rescue move. Here are steps to make it work:

- Map Your Cash Needs by Quarter: Identify potential PO spikes, seasonal needs, or major launches ahead of time.

- Build a Capital Stack: Mix personal capital, revenue reinvestment, PO financing, grants, and equity where appropriate.

- Compare Cost of Capital: Know how PO financing fees compare to dilution or loan interest.

- Set Thresholds for Use: Use it for POs over a certain size, or when retailer terms are longer than 45 days.

When you plan for PO financing like any other tool in your financial arsenal, you can optimize for both growth and sustainability.

Watchouts: Not Every PO Should Be Financed

Just because a retailer sends you a big PO doesn’t mean it’s profitable—or smart—to finance it.

Before using PO financing, consider:

- Gross Margin Math: Will you still profit after the financing fee and fulfillment costs?

- Retailer Reliability: Are you confident this retailer will pay on time, and in full?

- Supplier Trustworthiness: You’re relying on your supplier to deliver quality goods on time.

- Customer Concentration Risk: Financing one huge order for one retailer can be risky if they don’t reorder.

Financing can amplify success, but it can also magnify problems. Make sure the economics still work after borrowing.

How to Prep Your Brand for PO Financing Success

To qualify for PO financing and get the best terms, you’ll want your house in order. Lenders will look for:

- A Confirmed Purchase Order from a creditworthy retailer or distributor

- Supplier Quotes or Invoices outlining cost of goods

- Clean, Organized Financials

- Clear Fulfillment Plans and Delivery Timelines

The stronger your documentation and forecasting, the easier it will be to get approved and negotiate favorable terms. Founders who are proactive—not reactive—tend to get better results.

Where to Start: Exploring PO Financing Options

If you’re ready to explore PO financing, there are several types of providers:

- Banks: Traditional lenders rarely offer true PO financing products, typically avoiding lending directly against purchase orders.

- Specialty PO Lenders: Flexible solutions, but varying requirements make comparing multiple options time-consuming.

- Marketplaces: Simplified process with access to several PO lenders through a single request, allowing brands to efficiently compare and choose the best offer.

As you evaluate options, ask:

- How fast is the funding process?

- What fees are involved?

- Who pays the supplier directly?

- Do they understand the CPG space?

A good financing partner should offer more than capital—they should offer transparency, guidance, and trust.

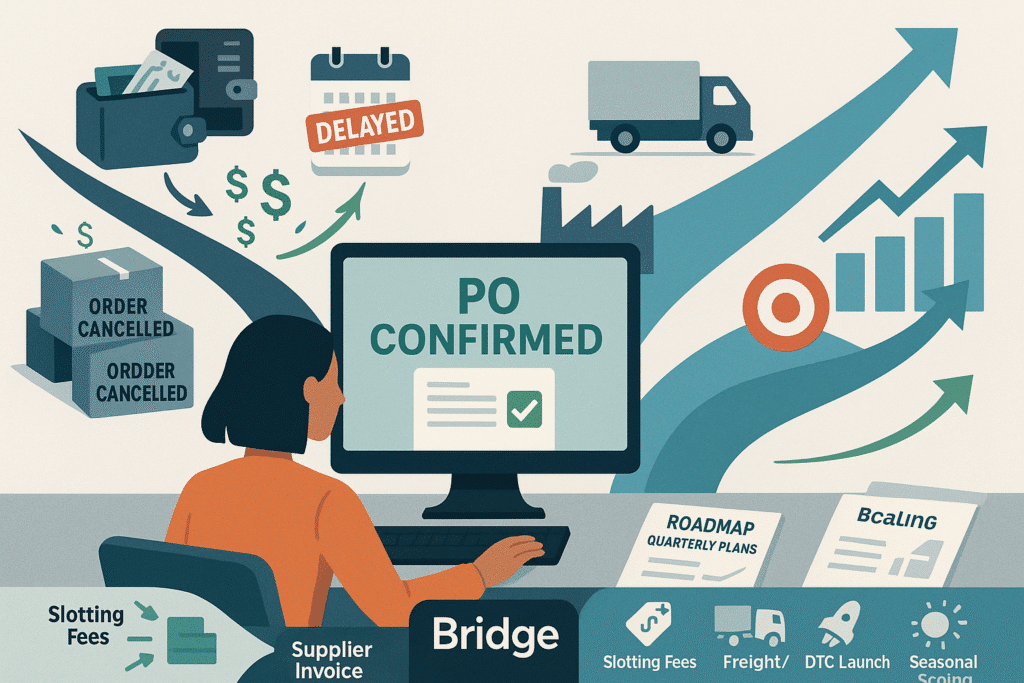

Partner Spotlight: Bridge

Whether you’re gearing up for a big launch or smoothing out cash flow during a retail ramp-up, Bridge helps remove the friction from finding the right financing partner—so you can stay focused on growing your brand. One platform simplifying PO financing for CPG brands is Bridge. With a single loan request, you can get matched with your best lender option—all while keeping control over your information and connections. Originally born out of Citibank, Bridge has partnered with large retailers like Walmart, Dollar General, Best Buy and many others.

Bridge stands out for:

- A founder-friendly approach with no spam or pressure

- Human advisors that are experts in PO and understand the CPG landscape

- A seamless digital process to compare offers and fund quickly

Whether you’re gearing up for a big launch or smoothing out cash flow during a retail ramp-up, Bridge helps remove the friction from finding the right financing partner—so you can stay focused on growing your brand.

Wrap Up

Purchase order financing isn’t just a lifeline—it’s a launchpad. For CPG founders navigating the unpredictable rhythms of retail growth, it can mean the difference between stalled momentum and a breakout moment.

Used wisely, PO financing helps you seize opportunity without sacrificing ownership or burning out your balance sheet.

👉 Ready to explore how PO financing could fit into your growth strategy? Check out Bridge to compare options and find the right funding fit when you need it most.