- Finance

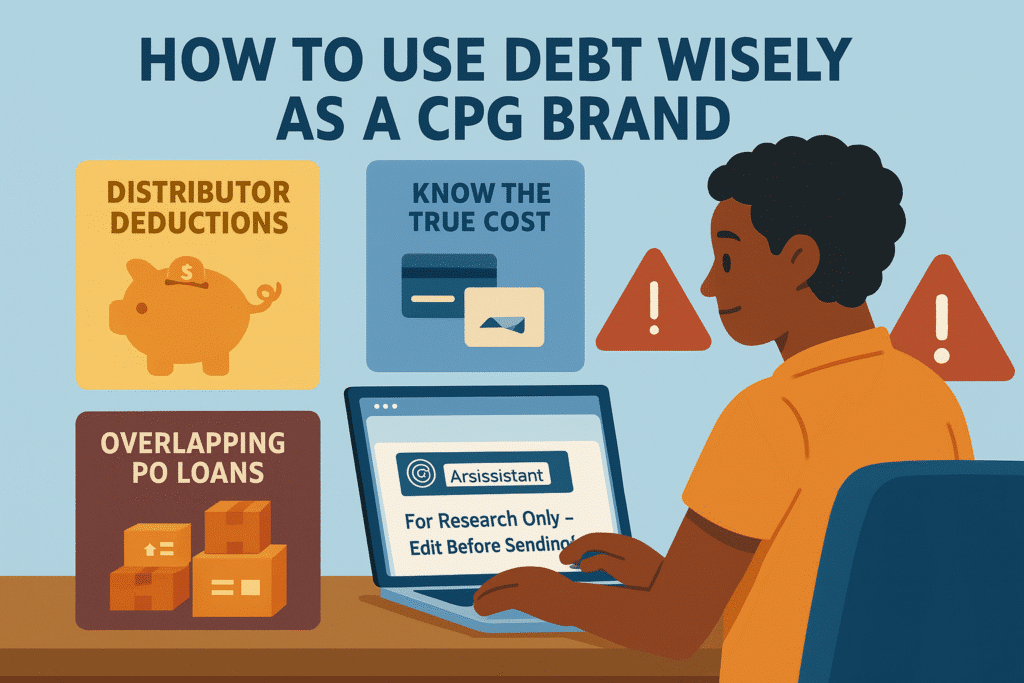

How to Use Debt Wisely as a CPG Brand

By:

Debt can be a powerful tool for growing your CPG brand — but only if you understand the risks and go in with your eyes wide open.

As a founder, it’s tempting to reach for capital when big orders come in or cash flow tightens. And in the right circumstances, debt can bridge that gap. It can help you buy raw materials, pay your co-manufacturer, or fund that next retail expansion. But I’ve seen too many founders run into trouble when the excitement of growth masks the realities of operating in the CPG world.

Here are the top four debt-related risks founders often overlook — and how to avoid them:

1. The Distributor Deduction Trap

You land a big PO from a national distributor. You take out a loan to cover production. The product ships. You expect to get paid in 30 days… but then the check comes — and it’s 30% less than you expected.

What happened?

Distributors often short pay invoices through deductions — for promotions, damaged goods, chargebacks, and compliance issues. These fees may be buried in your vendor portal or take months to resolve. If your financing depends on getting paid in full, you’re now in the red.

What to do:

- Understand the average deduction rate from your distributor before taking on debt.

- Build in a buffer (30–50%) when calculating your expected cash inflow.

- Set up internal systems to track deductions and dispute them quickly.

2. Know What You’re Really Paying: Understanding Interest Rates

Not all debt is priced the same — and some of the most expensive loans don’t look expensive upfront.

Many lenders advertise a “factor rate” (e.g., 1.2x payback on a $100K loan = $120K total repayment) or quote a monthly fee that doesn’t reflect the true annual interest. Some will charge interest on the original amount borrowed, even if you’ve already paid down most of it — making your effective rate far higher than expected.

What to do:

- Annualize the rate. A 3% monthly interest rate equals over 36% APR.

- Ask: Is interest calculated on the full amount or just the outstanding balance?

- Ask: Are there prepayment penalties? (Some lenders charge the full interest regardless of how fast you pay.)

- Compare offers apples-to-apples using APR (Annual Percentage Rate) instead of just monthly fees or flat repayment amounts.

If a lender can’t or won’t clearly tell you the effective APR — be cautious.

3. The Snowball Effect: Overlapping PO Loans

You start with one PO and take a loan to fund it. Then another PO comes in… and another. You take on more debt to fulfill the orders. But now you’re juggling three loans, overlapping payments, and cash hasn’t come in from the first order.

Suddenly, you’re deep in a liquidity crunch, with multiple lenders expecting repayment and your margin eroded by stacking interest.

What to do:

- Plan your debt repayment schedule around actual cash inflows, not hopeful timelines.

- Be cautious about stacking multiple loans — especially with different repayment terms.

- Use a line of credit or flex financing where possible, so you can borrow only what you need, when you need it.

4. The Fake PO Trap

Here’s a nightmare scenario: you get a purchase order from a retailer, rush to fulfill it, and later learn the PO was never approved or entered into their system correctly. You’re stuck with pallets of product — and a loan to repay.

This happens more often than you think, especially with large chains where communication gaps between buyers, category managers, and portals can result in invalid or fraudulent POs.

What to do:

- Always verify POs directly through your retailer’s procurement system or vendor portal.

- Confirm orders in writing and get an approved shipping window before producing.

- Avoid using debt to fund unverified POs — especially with new accounts.

So, Should You Use Debt?

Yes — but with a clear strategy and contingency plan.

Here’s how to use debt responsibly:

✅ Only borrow what you can repay even if invoices are delayed

✅ Build in buffers for deductions, delays, and overages

✅ Keep detailed records and stay on top of cash flow

✅ Avoid using debt for speculative growth — like unconfirmed new accounts

✅ Compare loan options carefully and understand the real cost

Debt isn’t bad — it’s a tool. But like any tool, it can help or harm depending on how you use it. The more you understand the unique risks of the CPG supply chain, the better you’ll be able to make smart, sustainable financing decisions.

Let your ambition drive your growth — but let your systems and foresight keep it on track.