- Finance, Operations

Do This To Get An Extra 60–90 Days To Pay Your Suppliers

By:

You just landed a big retail order. Exciting? Absolutely. But also terrifying. You need to place a sizable purchase order with your manufacturer, invest in packaging, and prep your fulfillment—all before a single dollar hits your bank account.

This is the moment when many CPG founders hit the wall. Not because their product isn’t selling, but because the gap between paying suppliers and receiving revenue is too wide. That cash crunch can stall a launch, kill growth, or force you into expensive financing options.

Sponsored by: Opply – get an extra 60 to 90 days to pay your suppliers—without burning relationships or sacrificing equity.

The Problem: Cash Flow Timing Gaps Can Kill Momentum

The average supplier wants to be paid upfront, or on net 30 terms if you’re lucky. Meanwhile, your retailer or distributor may not pay you for 45, 60, even 90 days.

That means you’re floating thousands of dollars with no guarantee of when it’ll come back. And when you’re launching a new SKU or scaling up for the holiday season, those costs only grow.

What happens if you can’t float it? You might delay the PO, try to cover it with equity financing, or worse—be forced to turn down growth opportunities altogether.

Cash flow gaps are one of the top reasons early-stage brands stall out. But they’re also solvable—with the right tools.

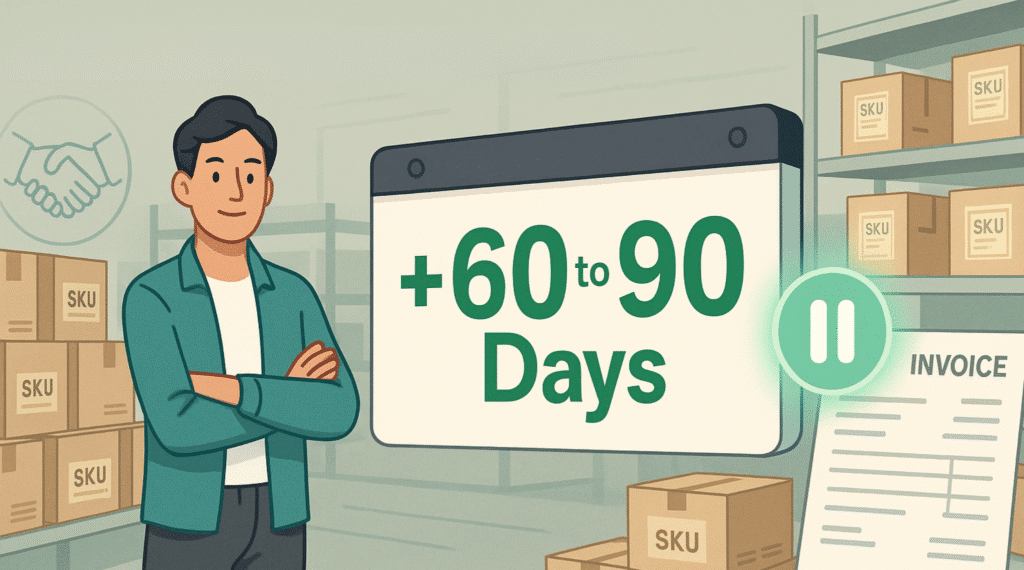

The Solution: 60–90 Day Supplier Terms

Enter Opply: a platform designed to simplify sourcing and procurement for CPG brands. One of their most powerful tools? A supplier payment solution that gives you 60–90 days to pay—while ensuring your suppliers get paid on time.

Here’s how it works:

- You maintain your supplier relationship as usual

- Opply pays your supplier directly, on the terms they prefer

- You repay Opply 60–90 days later, giving your business time to generate revenue

It’s like hitting “pause” on your biggest expense, just long enough for sell-through and retailer payments to catch up.

Keep Supplier Relationships Intact

One of the best parts about Opply’s system is that you stay in control of your supplier relationships. You don’t have to re-negotiate terms or ask your supplier for favors.

From your supplier’s perspective, nothing changes—they’re still getting paid as expected. That consistency builds trust and protects your reputation. And unlike traditional finance platforms, Opply doesn’t insert friction between you and your partners.

You get the capital flexibility without disrupting your operations.

When to Use Extended Terms Strategically

Extended payment terms are a powerful tool—but they’re even more effective when used strategically. Here are three common scenarios where CPG founders see the biggest impact:

- Seasonal Surges: Stocking up for Q4, summer promos, or back-to-school? Don’t tie up all your cash in inventory.

- Large POs from Retailers: Retail expansion is exciting—but those bulk orders require big upfront spend.

- New Product Launches: From R&D to packaging, launching a new SKU is costly. Free up cash to fund your rollout.

Compare the Costs: Flat Fee vs. Equity or Interest

Let’s talk about money. Opply charges a remove the flat fee on your spend—simple, predictable, and easy to budget for.

Compare that to the alternatives:

- Giving up equity: Raising capital for short-term operational costs can be expensive in the long run if you give up ownership.

- High-interest loans or credit cards: Compound interest and hidden fees can eat into your margins quickly.

- Personal Guarantees:

Real Impact: Breathing Room to Build

Imagine this: you place a $20K order to restock for a retail launch. You use Opply to fund the supplier payment and get 90 days to pay them back. Your product hits shelves in 4 weeks, and by day 60, your distributor payment clears.

You’ve made the sale, collected revenue, and can now pay Opply—all without touching your core operating cash.

This breathing room lets you focus on building your brand, not juggling bank balances.

Cash flow can make or break your next big move—but it doesn’t have to. With a solution like Opply, you can extend your payment terms by 60–90 days, keep supplier relationships intact, and avoid giving up equity or taking on debt.

It’s a tactical win that gives you the runway to scale with confidence.

Click the button below and we’ll connect you with their team to see how it can work for your brand.